Shoe retailer Imtaz Mahmud was sued in January 2014 for failing to repay some Tk1.5 lakh in principal and interest out of a Tk3.5 lakh loan he had taken out from the Babubazar branch of Agrani Bank four years ago.

The Artha Rin Adalat-3, Dhaka announced the verdict in the case in March 2016. The court asked the bank to recover the loan by auctioning Imtaz’s shop, the collateral against the loan. The appeal filed against the verdict was also disposed of within one year or so. Imtaz negotiated with the bank and eventually paid Tk2.5 lakh to the lender as interest, principal, and compensation.

The same branch filed another case with the same money loan court in 2012 against water transport owner Hafizur Rahman for defaulting on a Tk87 crore loan, which stood at Tk123 crore including interest. Ten years on, the case is still pending with the court. Incidentally, Hafizur Rahman is a relative of a former director of Agrani Bank.

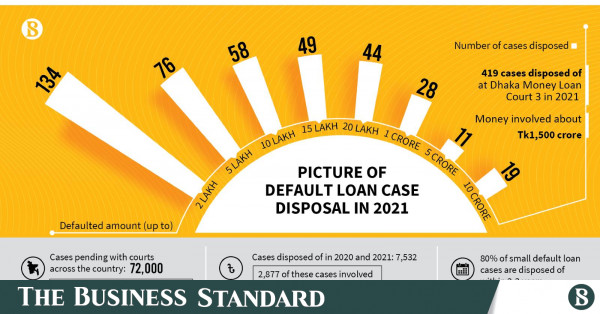

These two instances represent the overall situation of disposal of loan default cases in courts across the country – disposal of cases involving big amounts takes much longer.

According to Supreme Court sources, some 72,000 loan default cases are currently pending with various courts in the country, which involve around Tk1.4 lakh crore. Around 3,800 of the cases involve loan defaults of Tk100cr or more, and more than half of these cases have been pending for at least five years.

On the other hand, 7,532 cases were disposed of in the last two years,…