Consensual-hallucination stocks and crypto just keep on giving.

By Wolf Richter for WOLF STREET.

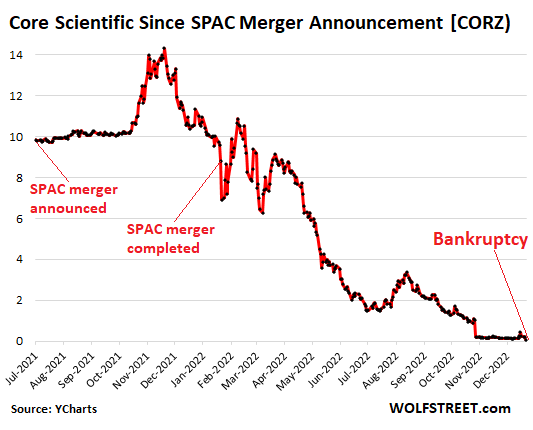

Austin-based Bitcoin miner and crypto-hosting-platform Core Scientific – one of the largest publicly traded crypto miners with data centers in several states, including Texas – filed for chapter 11 bankruptcy on December 21, just about exactly 11 months after going public via merger with a SPAC on January 20, 2022.

The day the merger with the SPAC was completed on January 20, the stock had a market cap of $2.8 billion, already down sharply from the peak of $4.5 billion after the announcement of the merger but before the completion of the merger. Today, forget it. Shares are at a few cents (data via YCharts):

On November 22, it reported that it had lost $435 million in the third quarter, on $162 million in revenues; and that it had lost $1.7 billion in the first nine months, on $519 million in revenues. So now Core Scientific is another one of the heroes in my pantheon of Imploded Stocks to have filed for bankruptcy.

Don’t worry, no one is going to jail here. Regulators slept through all this. This is just another act in the superb hype-and-hoopla show that is drawing to a close. A restructuring deal with a group of creditors representing “over 66%” of $550 million in secured convertible notes has been agreed on. Stockholders have already kissed their money goodbye because they eagerly believed what they were told at the time they bought this stuff,…