Chinese banks are rushing to boost capital as they prepare for a potential spike in bad loans due to the economic slowdown and spreading housing crisis.

A record amount of fresh money has come from financial markets, with banks selling 29% more bonds in the first half of the year compared to last year to replenish capital and cover credit losses. Local authorities also provided funds from government bond sales to help cash-strapped regional lenders.

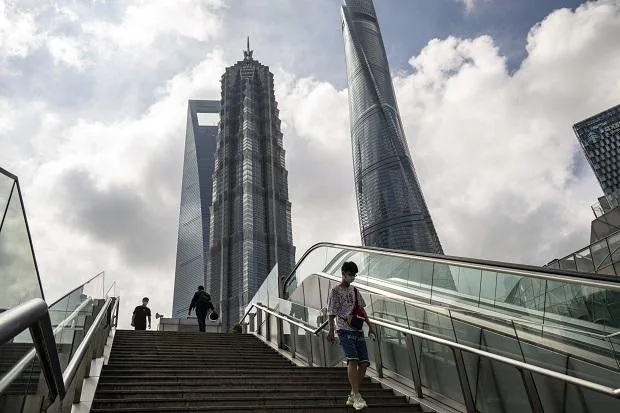

China’s economy grew at the weakest pace in more than two years in the second quarter due to Covid lockdowns and a protracted housing market downturn, stoking worries about an increase in companies and individuals who cannot repay loans. Those fears deepened recently when hundreds of thousands of home owners said they would stop paying the mortgage on houses that aren’t built yet, raising the pressure on developers, who may face more difficulty selling projects and also have to repay banks loans.

Also Read | Chinese Gen Z are underemployed and lowering their ambitions: Report

“We believe that asset quality is worsening due to Covid-related lockdowns, the property slump, the risks associated with small and micro loans, and the general economic slowdown in China,” said Harry Hu, a senior director at S&P Global Ratings. The capital injections from the government “will help those…