FTX has turned to Sullivan & Cromwell veterans who aided major restructurings, including Eastman Kodak Co., to sort out the crypto exchange’s affairs in Chapter 11.

Andrew Dietderich, co-head of restructuring for the white-shoe firm who helped guide Kodak’s 125-country reorganization, is leading a legal team at the firm advising FTX.

He’s aided at the Wall Street firm by partners James L. Bromley, who led Nortel Networks US Chapter 11, and Brian Glueckstein, who represented Fiat Chrysler in matters including the insolvency and restructuring of Takata Corp.

The FTX debacle sets up an “all-hands-on-deck situation” requiring dozens of attorneys working around-the-clock, said Daniel Besikof, a restructuring partner at Loeb & Loeb.

“The task they have cut out for them is to figure out where the assets are, where the claims are, and what portion of the business, if any, is viable,” Besikof said.

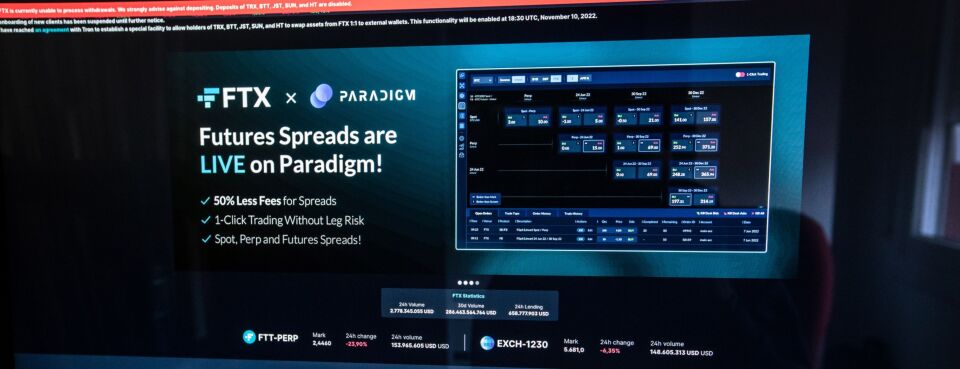

FTX’s Nov. 11 bankruptcy filing came at the end of a week that rocked the crypto world, including a 23% drop in Bitcoin as investors wondered how widely the collapse of the exchange would be felt.

FTX did not immediately return a request for comment on its outside and in-house legal representation. A Sullivan & Cromwell representative did not immediately return a request for comment.

‘Increasingly Dire’

The crypto exchange engaged with Sullivan and Alvarez & Marsal, a consulting and restructuring firm that advised Lehman Brothers in its 2008 bankruptcy, as issues relating…