This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy.

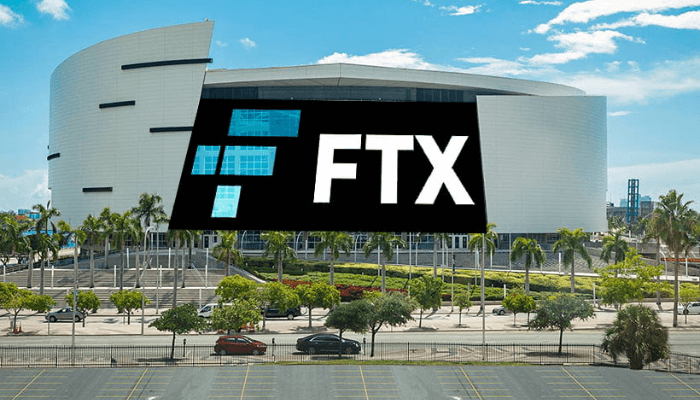

After spurring a ferocious wave of volatility that has ricocheted across the entire crypto sphere and bled into high-beta US equities, the FTX exchange might just be able to survive after all.

For those who might be unaware, FTX essentially suffered a bank run when Binance announced to dump its holdings of the FTT token due to the outsized exposure that Alameda Research – the trading arm of FTX’s founder Sam Bankman-Fried (SBF) – maintained to this synthetic coin on its books, which, according to Binance, amplified the risk around the FTT ecosystem. Bear in mind that FTX incentivized its users to hold the FTT token by offering attractive discounts on trading fees along with a host of other rewards. The exchange maintained FTT’s value by using a third of its trading commissions to buy back FTT coins, which were then burnt.

In reality, FTX and Alameda were running a Ponzi scheme where Alameda was able to acquire FTT coins at very cheap prices (through pre-mining, etc.) while FTX artificially inflated the coin’s price via regular burns. Alameda then posted its FTT holdings as collateral to borrow around $6 billion in FTX client funds. These client funds were used by Alameda to place leveraged bets. However, the gameplay ended when Binance’s decision to dump FTT unleashed cascading…